The Lowe’s Advantage Card is a closed-loop card, which means you can only use it at Lowes Synchrony. For example, you cannot use it in restaurants, grocery stores, or other places that accept credit cards. The Lowe’s Advantage Card is a very specific purpose card. Due to its limitations, it will not (and should not) be the main card in your wallet.

or

For most people, your primary card should be an everyday spending card at a variety of stores, which likely means a widely accepted Visa, Mastercard, or American Express card. Alliant Visa Platinum Rewards can be a good candidate for first place if you have decent credit.

By registering your new Lowe’s credit card online, you can access and manage your account online from the comfort of your own home. Log in anytime to check your balance or monthly payments. Lowes Synchrony Bank services are available online 24 hours a day, 7 days a week.

How To Register At The Official Portal?

The first Lowes Credit Card login step is to provision an internet-connected device. After that, make sure you have a credit card and the correct URL to complete the online registration of your Lowes credit card account. In addition, we can help you understand all the steps required to create a Lowes credit card account. In fact, you start the account immediately when you register with us.

- Log in to the Lowes Credit Card website shown here using a browser of your choice: www.lowes.com

- Login forms are the most popular design to get attention. If you don’t have a Lowes Credit Card login account, skip the registration prompts and skip to the last part of the registration page.

- Search ‘I want to register or register’.

- Click the blue registration link and then click.

- A new page will appear. This is Lowe’s credit card account registration page.

- Fill in the form with the notification information, then press the “Register” and then “After” button.

- Do not hesitate to click on “Accept the general conditions” before clicking on the “Accept the general conditions” button.

You are glad that you were able to open your Lowe credit card account by following the steps above. The best way to test the newly created account is to try logging in using the credentials you created.

Login Process For Registered Users At www.lowes.com

This is basically logging into your Lowes Credit Card account. I hope you still remember all the details you entered in the open journal columns. It’s great to work with Lowes.

- Open the Lowes Credit Card Login page at www.lowes.com

- In the second column, enter your User ID and Password.

- Go to Secure Connect or Secure Connect and tap Lowes Credit Card Login.

- Welcome to Lowe’s Online Credit Card Management website. What else do you want to do with your Lowe credit cards? Tell us in the comments box on the right.

Lowes Login Benefits

Project Financing

The Lowes company makes this option available to its customers because it believes there should be multiple payment options for large projects with Lowes Credit Card Log In. So, for orders over $2,000, customers can apply for any financing option at Lowes Credit Card Log In as it will not be automatically applied. Customers should note that the 5% offer does not apply to these financing options. The Lowes Synchrony Bank offers the following options:

- 36 monthly payments at 3.99% APR

- 60 monthly payments at 5.99% APR

- 84 monthly payments at 7.99% APR

- 5% every day

Customers who purchase with the Lowes Advantage Card receive a 5% discount on every purchase. Customers should note that this 5% offer does not apply to employee discounts, gift cards, or military discounts. This Lowes Credit Card offer is not included in some brands.

6 Months Of Financing

This option does not offer a 5% discount. The Lowes Card brand offers this option for orders over $299. If payment is made within six months from the date of purchase, the customer will be charged a 0% annual percentage fee. A rate of 26.99% will be charged if the customer does not meet the requirements.

5% Deal Or Special Financing

Well, it depends on the customer himself, as he has the possibility to get 5% on each purchase or special financing. Customers cannot use both options, they must choose one. If you choose the first option, you earn 5% on each purchase, but if you choose the special financing option, you must pay the amount to Lowes Synchrony within six months, so you will be charged 0% APR.

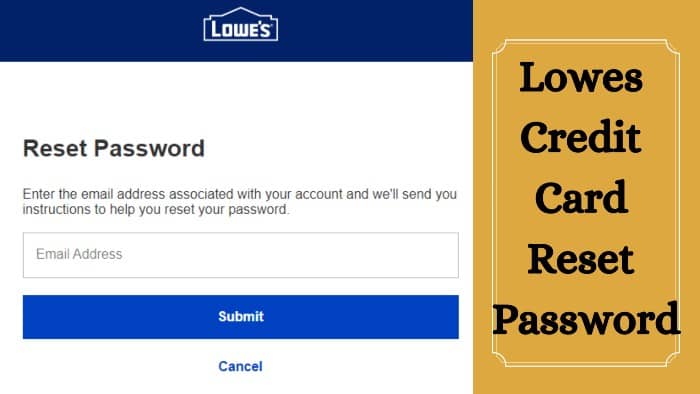

How To Reset Your Lowes Credit Card Log In Password?

If you’ve forgotten your Lowes credit card login code, the Lowes Credit Card Phone Number should worry you! Here you need to follow some steps to recover your password at www.lowes.com.

- Check formal funds for Lowes Credit Card login first.

- Then on the login page, select the password reset solution that you will see.

- Enter your customer ID and zip code today.

- Then choose an appropriate new code that is easy to remember.

- In later steps, you will be able to log back into your credit card account.

- See also PLS Xpectations Card Login – A manual for My Lowes Credit Card

My Lowes Credit Card will allow you to get your Lowes Credit Card login code and recreate your business account.

Types Of Lowes Business Cards

Depending on your needs, Lowes Card offers four different business credit card options.

Lowes CC Business Advantage

- Request multiple My Lowes Card for the account

- Receive detailed and itemized invoices

- Download up to six months of activities in Excel, Quicken, or QuickBooks format

- 0% interest for 60 days

Business Lowes CC Rewards Card

- Use at any Lowe’s store and anywhere American Express is accepted

- Get $100 back on approval

- Get cashback on all your purchases

- No annuity

Lowes CC Business Account

- View detailed transactions, SKU-level details, authorized buyer information and more.

- Delivery against invoice

- You can receive PDF invoices by email

- Extended runtimes available

- Lowe’s preloaded discovery map

- No credit check needed

- Funds with debit, credit, or business current account

- Organization by cardholder

| Official Name | Lowes Credit Card |

|---|---|

| Portal Type | Login Portal |

| Managed By | Lowes |

| Language | English |

| Country | USA |

Card Fees And Lowes Credit Card payment

Here is a brief overview of typical fees and charges associated with a Lowes Credit Card Login:

Annual Quota for Lowes CC

If you do not use Lowes Credit Card payment, so long as you have it, you do not lose any money if you don’t use it.

APR at Lowes CC

The standard APR on the Lowe’s Advantage Card is 26.99%. As usual with store Lowes. Avoid APR fees by paying your balance in full each month or at the end of the funding period.

Late Payment Fees

The Lowe’s Advantage Card charges a $27 late fee if you miss or miss a payment. If you have been late on Lowes Credit Card payments within the last six months, you will be charged a late fee of $38.

Terms And Conditions To Be Followed

Like any credit card, Lowes Credit Card has terms and conditions that should be carefully reviewed. Terms and conditions include APR, late fees, penalties, and other useful information.

Below is the updated Benefit Card information of Lowe’s Credit Card Application:

- APR: 26.99%

- In late payments, the consumer could be charged a fee of up to $40 if they do not make the minimum payment by the due date

- Cardholders who select the 0% financing offer on purchases of $299 or more and do not pay the entire purchase within six months will be charged interest through the date of purchase. In addition, the minimum monthly payment on the card is not always enough to fully pay off the purchase in six months.

Therefore, borrowers who want to avoid unexpected interest charges should be careful not to leave a balance after a six-month period.

Learn More About Lowe

Lowes is definitely a national retail company. John Lowe and Carl started their organization in 1946 with just a small electronic maintenance chain. This company is perhaps the second-largest hardware store in the world, with 160,000 employees and 1,754 stores in the United States, Europe, and Mexico.

The company and its hardware stores accept Charge, National Show, Mastercard, Find, and Lowes Credit Card payments. You can easily renovate your home through a low credit card registration website with Lowe’s Credit Card Application. You can also shop online, spend money online and manage your account online with Lowes Credit Card payment.

Lowes Synchrony Bank offers its customers a 5% discount on every purchase. Also includes 0% interest on purchases of $299 for six months. You can select map features for more information.

Common Questions

Is there strong pressure for increased lending at Lowes Credit Card?

If you request an increase in the credit limit on your Lowe’s Loyalty Card, the issuer will cautiously withdraw your credit report, which will not affect your credit score. Without your Lowe’s Credit Card Application permission, the Lowes Credit Card cannot make a large payment.

Could the request for an increase in your credit limit negatively affect your credit score at Lowes Synchrony?

Raising your Credit Card limit shouldn’t negatively affect your credit rating, as long as it doesn’t increase, you spend a lot, and you make your payments on time. This, combined with responsible measures like paying on time, can help improve your credit score of Lowes Credit Card Number over time.

What is an acceptable credit limit increase request?

You can ask for more if you have outstanding or even good credit. The important thing to remember is that you shouldn’t seem too confident, nor should you ask for too much. Instead, ask for a 10-25% increase or even $250 for every $1,000 in balance you already have.

What is the maximum Lowes Card limit?

Lowe’s credit card has a $500 limit. The credit limit on a Lowes card can vary, depending on the customer’s credit score, annual income, and other considerations, but the Lowes card usually has low credit limits, to begin with.

Customer Service

You can also increase your credit card limit by speaking with a representative over the Lowes Credit Card Phone Number.

- Call (800) 444-1408 or visit a Lowes Synchrony store to request an increase in your Lowes card credit limit or visit www.lowes.com.

- Explain that you want to increase the credit limit on your Lowes Advantage card.

- You must disclose your annual net income and desired credit limit.

- Lowes Credit Card Number will ask for your consent to a credit report request. They will review it to determine if you qualify for a credit limit increase.

- If you qualify for a Lowe credit limit increase, your customer service representative can notify you immediately via Lowe’s Credit Card Application. Depending on the results of your credit report request, they may need to call you for confirmation.

Conclusion

In the above article, we have given all the Lowes card-related information in order that it will be helpful to you while the login procedure. We have provided with lowes official link benefits, features, and also login procedure. If you still face any kind of difficulty then contact the customer service department.